Building a stronger financial future for

St. Louis families

On Our Block® is an economic empowerment platform for underbanked communities, powered by Mobility Capital Finance, Inc. (MoCaFi).

On Our Block® is launching an exciting new investment program in St. Louis that will create a managed fund of $1.5 million on behalf of 300 eligible 7th graders in the greater St. Louis Area.

These funds will be held in an investment account managed by the investment company Edward Jones.

In May 2030, subject to certain conditions described below, beneficiaries can withdraw their share of the invested funds to strengthen their financial futures*.

It takes a village to build a prosperous community

MoCaFi — a national community banking platform — is working with James S. McDonnell Foundation, Edward Jones, and MoneyByrd to help St. Louis families overcome the barriers to wealth creation.

Investment Grant:

The James S McDonnell Foundation

Will donate $1.5 million for 300 income-eligible 7th grade students enrolled in eligible St. Louis area public schools.

Investment Management:

Edward Jones

Will oversee the grant investment, provide financial advisors as resources throughout the program, and upon program completion, assign financial advisors to each selected 7th grader’s family

Financial Guidance:

MoneyByrd

Provides website and mobile app access to investment account balance information and offers opportunities for selected families to participate in financial education.

Program Management & Community Banking:

MoCaFi

Provides program management, access to insured deposit accounts , and financial services to selected family’s wealth journey.

On Our Block®: St. Louis Investment Program at a Glance

School Enrollment Eligibility:

7th-grade students enrolled in a public school for the 2024/25 school year in one of the following school districts: Ferguson-Florissant, Hancock Place, Hazelwood, Normandy Schools Collaborative, St. Louis Public Schools, University City.

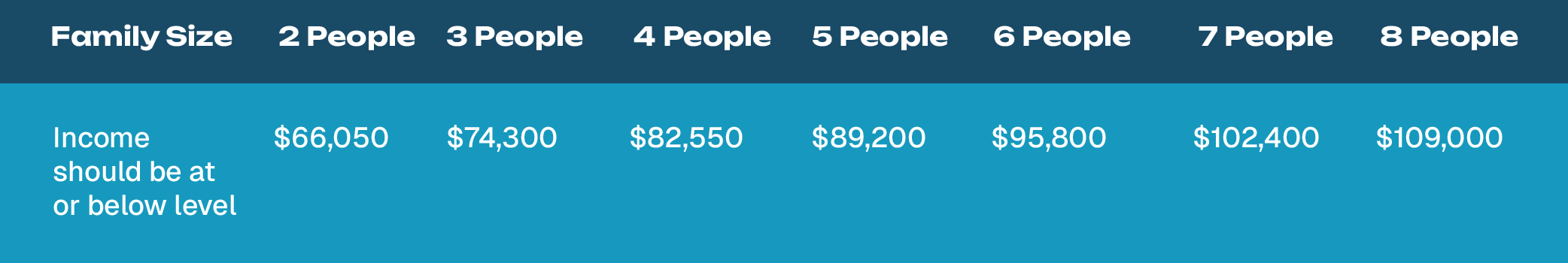

Income Eligibility:

Gross household income must be at or below 80% of the 2024 Area Median Income (AMI). Read more about Area Median Income and other eligibility criteria in the FAQs.

Program Duration:

Invested funds will mature over a 5-year period. After this time, the money is eligible for withdrawal if the beneficiary has reached the age of 18, and met all program conditions. The withdrawal period will stay open for four years.

Investment Amount:

$1.5 million ($5,000 per student) in an Edward Jones-managed pooled investment account.

Eligible Criteria:

The withdrawn funds can be used for higher education, vocational training, entrepreneurship, homeownership, and retirement savings.

Selection Approach:

Let’s capture this moment to create opportunity for all St. Louisans

-

Build lasting wealth

-

Get investment guidance

-

Access to safe financial services

FAQs

What does the On Our Block®: St. Louis Investment Program do?

On Our Block®: St. Louis is designed to help eligible students plan for and strengthen their financial futures by providing them with a financial asset and free access to financial planning services. An application is necessary to determine eligibility to participate in the program. Not all eligible applicants will be chosen to receive the grant and financial planning services. From the eligible applications, 300 7th graders from designated communities in and around St. Louis City and County will be randomly selected for the program.

How does the fund work.

This opportunity is made available through a one-time investment of $1.5 million on behalf of 300 eligible 7th grade students. These funds will be held in an investment account managed by investment company Edward Jones. Beginning in May 2030, when all program conditions have been met and if the beneficiary has reached the age of 18, they can withdraw their share of the total value of the investment fund and use it for:

- Tuition for college, university, or vocational training

- A down payment for a home purchase

- Starting or purchasing a small business

- Opening their own retirement savings account

Each person’s share of the fund is expected to be 1/300th of the total value of the fund – at initial deposit this amounts to $5,000 per beneficiary.

The funds available for withdrawal in May 2030 may be greater or less than the initial $5,000 investment per beneficiary depending on market performance.

Who is eligible to apply?

Parents or legal guardians should apply on behalf of their 7th grade student. The following conditions must be met:*

- The applicant must be or have been in 7th grade during the 2024-2025 school year

- The applicant must be enrolled in a public school in one of the following districts:

- Fergusson-Florissant School District

- Hancock Place School District

- Hazelwood School District

- Normandy Schools Collaborative

- Saint Louis Public Schools District

- School District of University City

- The 7th grade applicant must have a Social Security Number or Tax Identification Number

- The gross, total family income of the 7th grade applicant’s family must be at or below 80% of the 2024 Area Median Income for St. Louis County. Area Median Income limits vary depending upon household size. See below for income eligibility by family size.**

**Source: https://www.stlouis-mo.gov/government/departments/community-development/residential-development/income-limit.cfm

**Source: https://www.stlouis-mo.gov/government/departments/community-development/residential-development/income-limit.cfm - If selected, the 7th grade applicant and their parent (s) must agree to participate in occasional surveys and/or interviews about Level Up

Not all eligible applicants will be chosen to receive the grant and financial planning services. 300 eligible 7th graders from select communities in and around St. Louis City and County will be randomly selected for the program.

Does it cost anything to apply?

On Our Block®: St. Louis is entirely free. You will never be asked to pay for anything. This innovative program is made possible through generous funding from the James S. McDonnell Foundation and Edward Jones.

Edward Jones may charge the fund a management fee for managing the investment account which may reduce the overall value of the account, but there is no direct fee charged to beneficiaries at the time of funds withdrawal.

Applicable taxes on withdrawn funds may apply at the time of withdrawal.

How do beneficiaries of the fund get access to the money?

Beginning in May 2030, when all program conditions have been met and if the beneficiary has reached the age of 18, they can withdraw their share of the total value of the investment fund at the time of withdrawal. A formal request to withdraw funds for one of the allowable purposes must be made:

-

Tuition for college, university, or vocational training

- A down payment for a home purchase

- Starting or purchasing a small business

- Opening their own retirement savings account

Mobility Capital Finance, Inc. is responsible for managing the disbursement of eligible funds to program beneficiaries.

Student beneficiaries (e.g., those who have been randomly selected) of the program will be notified of the full program conditions at the time of selection – which mainly include participating in free financial education and mentoring opportunities aimed at improving knowledge and confidence to plan and manage their own investments.

On Our Block® is not a financial advisor and does not provide personalized financial advice. Any third-party financial education services offered are for educational and informational purposes only and should not be considered financial advice. Individuals should consult with a qualified financial advisor or professional before making any financial decisions. On Our Block is not responsible for any actions taken based on information provided through third-party financial education or services.

*Other terms and conditions may apply