Rent-2-Home: Transition from Lease

To Mortgage

Hosted by

Saturday, August 26th from 12 pm to 3 pm

at Birmingham Civil Rights Institute

520 16th St N, Birmingham, AL 35203

ON OUR BLOCK BY MOCAFI™ IS A NEOBANKING MOVEMENT TO HELP COMMUNITIES BUILD WEALTH FROM SCRATCH.

MoCaFi is a financial services platform to help excluded communities create pathways to wealth through better access to public, private, and social capital.

On Our Block pop-ups bring mobile banking, financial coaching, and wealth education to neighborhoods traditionally excluded from economic opportunities

What To Expect

$100 Deposits

First 100 attendees with a MoCaFi Bank Account get $100 deposited on-site

Keynote Panel

Rent 2 Home: How to move from lease to mortgage

Isis Jones, Room 1420 • Carlos Aleman, CEO, HICA • William Barnes, President & CEO, National Urban League • Kelliegh Gamble, Birmingham Housing Authority VP • Lila Hackett, Executive Director, Housing Center of Northern Alabama • Carol Clarke, Executive Director, Birmingham Neighborhood Services

Homeownership Coaching Sessions

Speak with homeownership experts from Birmingham Urban League & Neighborhood Housing Services of Birmingham

Sounds by Chris Coleman and Food by Chef Simone

Sounds by Chris Coleman

and Food by Chef Simone

MoCaFi Is Banking For The Community

Big Boy, Host of the nationally-syndicated morning show Big Boy’s Neighborhood

“Everyone should have access to credit to build wealth”

— Tracie Anderson, Economic Inclusion, TransUnion

“We’re serving this knowledge block by block.”

— Brandon “Stix” Salaam-Bailey, Founder of ThinkWatts

MoCaFi Bank Account

Do all of your banking with an app and a debit card

APPLY WITH YOUR GOVERNMENT ID AND HOME ADDRESS

MoCaFi-powered bank accounts are available to anyone whose identity we can verify. We can use SSN, Passport, or Foreign ID. Credit score, banking history, or deposit amounts have no factor in your application.

NO FEES TO DEPOSIT SPEND OR GET CASH

No-fee cash withdrawals at Allpoint™

or Wells Fargo ATMs. No-fee cash depositing on the VanillaDirect™ Network including Rite-Aid, Walgreens, Dollar General, and Family Dollar. No fee electronic Bill Pay.

GET PAID 2 DAYS BEFORE PAYDAY¹

After making one verified direct deposit to your account, you are eligible to receive direct deposits from that employer or benefits provider up to 2 days earlier* than scheduled.

REPORT ON-TIME RENT PAYMENTS TO EQUIFAX AND TRANSUNION²

Use the Bill Pay feature in the app to pay rent checks by mail. Rent Bills can be reported to Equifax and TransUnion as a way to boost your credit score with positive payment history.

SEND and RECEIVE MONEY AT NO COST BETWEEN CONNECTED ACCOUNTS

Send and receive money between friends and family with a MoCaFi-powered bank account.

CONTACTLESS PAYMENTS AT THE REGISTER

Use your debit card to pay with Apple Pay® and Google Pay®.

Blueprint by MoCaFi

Build your path to homeownership

WEALTH IS FOR YOU

Set S.M.A.R.T. goals & home ownership budgets

KNOW YOUR WORTH

Automatically separate assets and liabilities from your bank account and credit profile.

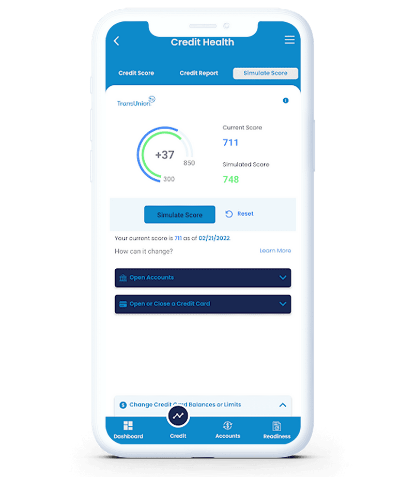

TURN CREDIT INTO AN ASSET, NOT A LIABILITY

TransUnion Credit Compass™ uses artificial intelligence to simulate your path to perfect credit.

GET A YES ON YOUR MORTGAGE APPLICATION

Rent-2-Home Blueprint and Mortgage Readiness algorithm lets you know exactly what you need to get approved for your first mortgage.

YOUR CONNECT TO FINANCIAL EMPOWERMENT

Share your Blueprint profile with MoCaFi to get personal coaching and lender referrals.

A Community Neobanking Movement

* Federal Reserve Report on Economic Well-Being of US Households, 2019

The MoCaFi Bank Account and the MoCaFi Debit Mastercard are issued by Sunrise Banks N.A., Member FDIC, pursuant to a license from Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. The card may be used everywhere Debit Mastercard is accepted. Use of this card constitutes acceptance of the terms and conditions stated in the Account Agreement. The MoCaFi Bank Account is marketed and administered by MoCaFi. MoCaFi is a financial technology company and not a bank. Banking services are provided by Sunrise Banks N.A. Your funds are FDIC insured up to $250,000 through Sunrise Banks, N.A., Members FDIC.

MoCaFi credit and wealth-building features are not Sunrise Banks N.A. products, nor does Sunrise Banks N.A. endorse these features.

1Faster funding claim is based on a comparison of our policy making funds available upon receipt of payment instruction versus the typical banking practice of posting funds at settlement. Fraud prevention may delay the availability of funds with or without notice. Early availability of funds requires payor’s support of direct deposit and is subject to the timing of payor’s payment instructions.

2Rental Payment Reporting is not Sunrise Banks N.A. products, nor does Sunrise Banks N.A. endorse this feature.

Apple® is a trademark of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Google Play® and Google Play® logo are trademarks of Google LLC.

Copyright © 2016, 2023 Mobility Capital Finance, Inc. All rights reserved.

Mobility Capital Finance, Inc.

1 Washington Park, 7th Floor Newark, NJ 07102

1-800-342-7374

support@mocafi.com