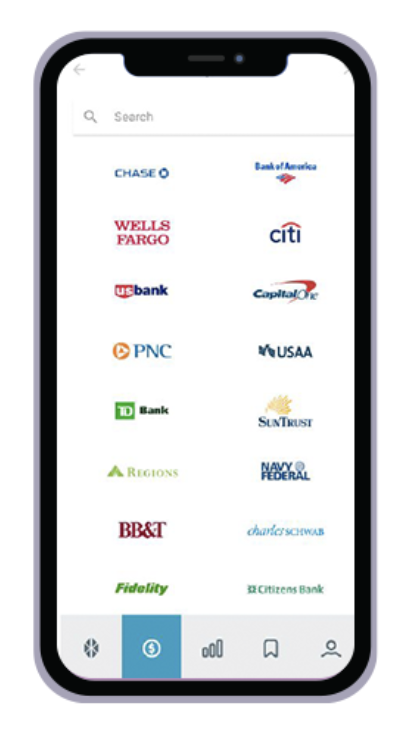

Can I use my existing bank account with MoCaFi?

Yes, you can link your other bank account(s) to your MoCaFi Mobility Bank Account.

In the MoCaFi app, head to the Money tab. Select connect accounts located at the top of screen under your profile picture.

Follow the prompts to select your bank from the list and enter your credentials to complete the setup.

Move Money From A Connected Account

How do I order a debit card?

When you download the MoCaFi app for the first time you will be asked to sign up.

From there you will follow the onscreen prompts to open a MoCaFi Mobility Bank Account.

Once you’ve successfully completed this process, your card will be on its way! In the meantime, to access your card information, head over to the profile tab, select Your Card, and tap the card image.

Tapping the card image will prompt the app to display your card information.

Open A MoCaFi Bank Account

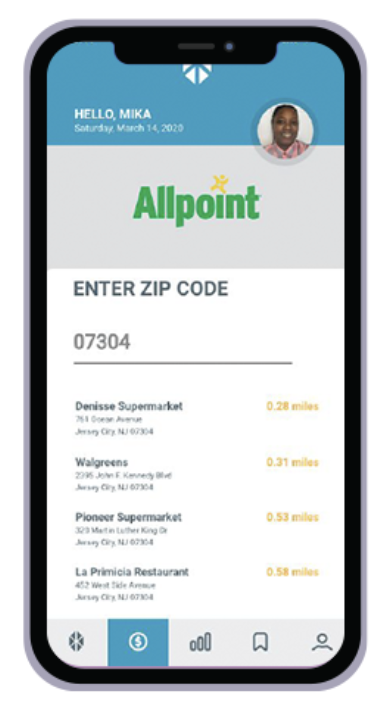

How do I avoid ATM fees?

Your MoCaFi Debit Mastercard® can be used at any of the 55,000 AllPoint Network ATMs and at any Wells Fargo ATM to withdraw cash with no surcharge fee.

For AllPoint ATMs, look for the AllPoint logo or use the ATM locator inside the MoCaFi app to find one near you. For Wells Fargo ATMs, look for the Wells Fargo logo.

When using an ATM outside of the AllPoint or Wells Fargo networks, the banks charge a withdrawal fee and MoCaFi automatically charges $1.98 for that usage.

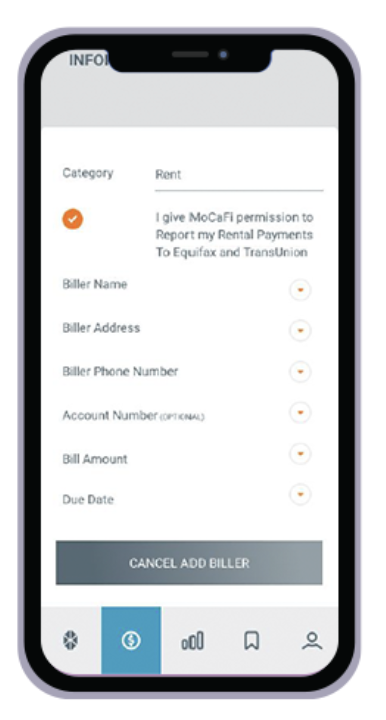

How does Rent Reporting work?

Use our Bill Pay feature to send check payments to your landlord and opt-in to report those payments to Equifax and TransUnion. Positive rent payment history can help boost your score. In addition to monthly reporting, we can also submit a one-time report of up to 24 months of past rental payment history.

If you have proof of consecutive rental payments, we recommend reporting those first by contacting our Rent

Payment Team:

Purlife Spence

purelife.spence@mocafi.com

Shy Jenkins

shy.jenkins@mocafi.com

Once you’ve reported your payment history, then head to the Money tab in the MoCaFi app. Select Pay Bills. Follow the steps to add a Biller. Use the MoCaFi app Bill Pay feature to pay your rent each month.

Pay & Report Rent To The Credit Bureaus

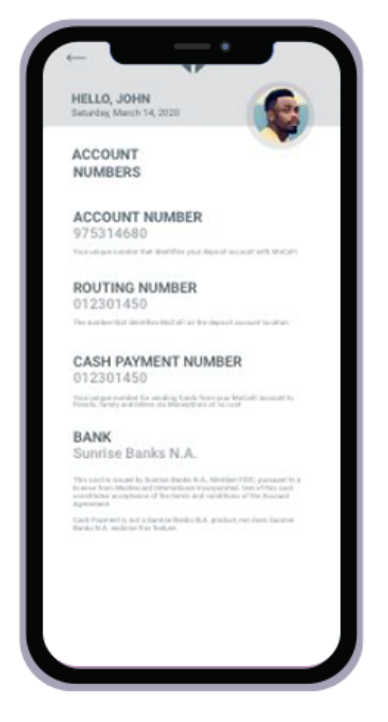

Where can I find my Direct Deposit information?

Signing up for direct deposit in the MoCaFi app is simple.

Head to the Profile tab.

Select Account Info from the list.

Make note of your account and routing numbers for setting up your direct deposit.

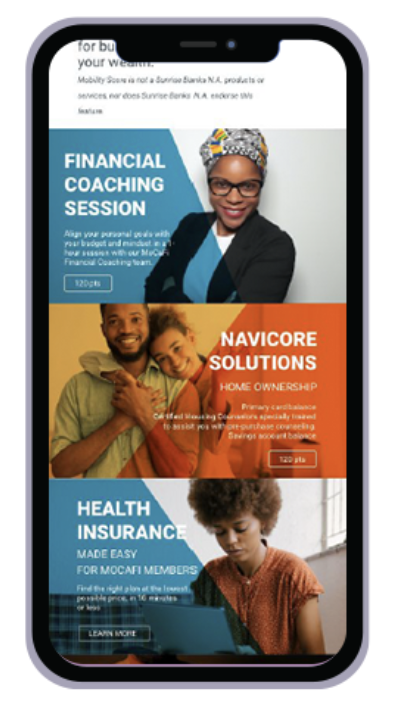

Why should I use the Mobility Score?

The Mobility Score measures and rewards positive financial health.

We use your activity in the MoCaFi app to assess money management, financial literacy, and financial planning activities. As you engage in activities in the MoCaFi app, your score will increase.

Your individual Mobility Score unlocks new services and

resources in the app.

For example, you may unlock access to personal financial coaching, housing counseling, credit score counseling, and more once you attain a certain score.

Posts from our blog that you might like:

It Might Be Time For A Checkup, Financially Speaking

It Might Be Time For A Checkup, Financially Speaking

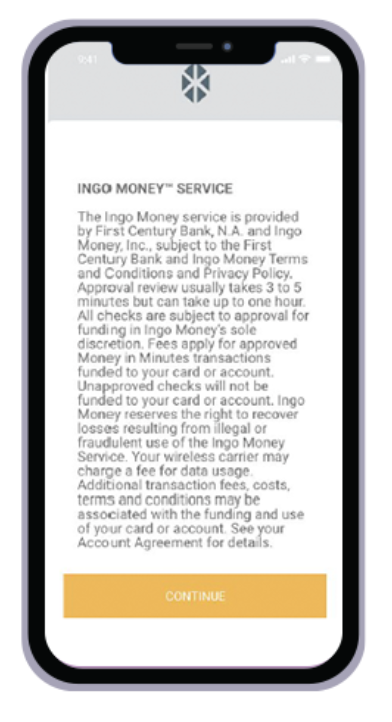

How do I cash checks in the MoCaFi app?

You can use the Ingo Money™ integration in the MoCaFi app to deposit a paper check at no cost.

Head to the Money tab in the MoCaFi app. Select Load Check.

Read the Ingo Money Service terms and follow the on screen prompts.

You’ll be asked to provide some basic personal information and to Accept/Decline the Privacy Policy.

Next, select Deposit Check Funds and follow the instructions to make a digital check deposit.

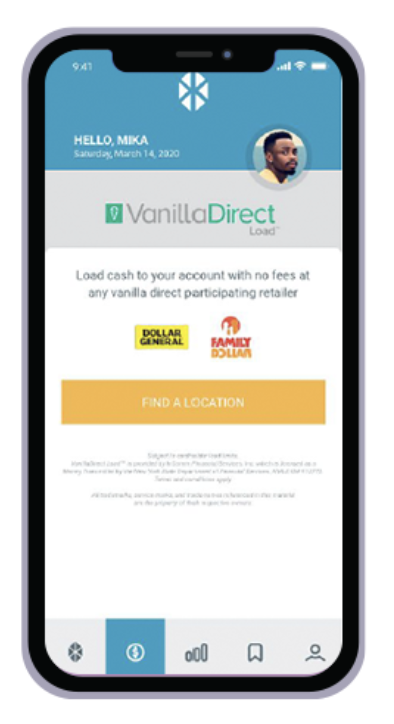

Can I deposit cash to my MoCaFi card?

You can use the VanillaDirect Load Cash integration to add cash to your MoCaFi Mobility Bank Account at no cost.

Currently MoCaFi cardholders can deposit cash, at no cost, at any Dollar General or Family Dollar location.

Head to the Money tab in the MoCaFi app. Select Load Cash to find a location near you where you can deposit cash.

Once in the store where you plan to make your cash deposit, a cashier will swipe your MoCaFi card to identify your account, then credit your account with the amount of cash you deposit at the register.